Consumers Want To Know Science Behind Health Care Advertising Claims, Survey Shows

SPRIM Research Also Shows Higher Self-Care Interest In US Than Brazil, Mexico

Executive Summary

Survey of 1,112 subjects during 2021 – 485 in US, 471 in Mexico and 156 in Brazil – also showed consumers are becoming more discerning and less impressed by claims based on recommendations by doctors or other health care professionals.

The US consumer products industry’s emphasis, along with public health authorities’ endorsement, on increasing self-care practices among consumers appears to be paying off compared to practices by consumers in Brazil and Mexico.

That’s one of the conclusions that Susan Dallabrida, consultancy vice president at market research firm SPRIM Global, a contract research organization conducting clinical trials in consumer health, nutrition and device categories, made from the results of a survey about consumers’ dietary supplement preferences in the three countries.

Another finding for Dallabrida from SPRIM’s survey of 1,112 subjects during 2021 – 485 in the US, 471 in Mexico and 156 in Brazil – is that consumers are becoming more discerning and more suspicious of ad claims based on references to unidentified research and on recommendations by doctors or other health care professionals.

“One of the differences that we saw is in the US, it seemed like the consumers in the US are very much a self-help group. Meaning, you've got consumers who are looking for answers, but they're looking to get the answer. The number one mechanism they use to get an answer is themselves,” Dallabrida said in an interview.

US consumers are more likely to access information online, either from brands or from third-party, neutral sources, about a health and wellness question and relevant products.

“They're reading the user reviews, they're looking for new research, they're looking for more information on that. And then they're making their buying decisions largely online through mass online retailers, like an Amazon, and secondly big chain retailers,” Dallabrida said.

“Those are their major drivers, they are not around discussions with their doctors.”

Companies marketing supplements and other consumer health products in the US, she added, “need to take that into consideration that a US consumer is looking very closely at your website, very closely at your research, your claims and all that information very closely, what other users are saying about the product.”

Not In Brazil And Mexico, Though

“When you go into places like Brazil and Mexico, we find a very different relationship between patients and brands there,” Dallabrida said.

“We found that the number one thing in terms of purchasing decisions is patients are looking to have those conversations with their doctors, with their nutritionist, with their dieticians. … The scenario there is, the leading driver is I go to my doctor, I ask my doctor, my doctor says and then I'm going to the local drugstore, possibly having further conversation, and making my decision.”

susan dallabrida: "One of the differences that we saw, it seemed like the consumers in the US are very much a self-help group."

Source: SPRIM Global

susan dallabrida: "One of the differences that we saw, it seemed like the consumers in the US are very much a self-help group."

Source: SPRIM Global

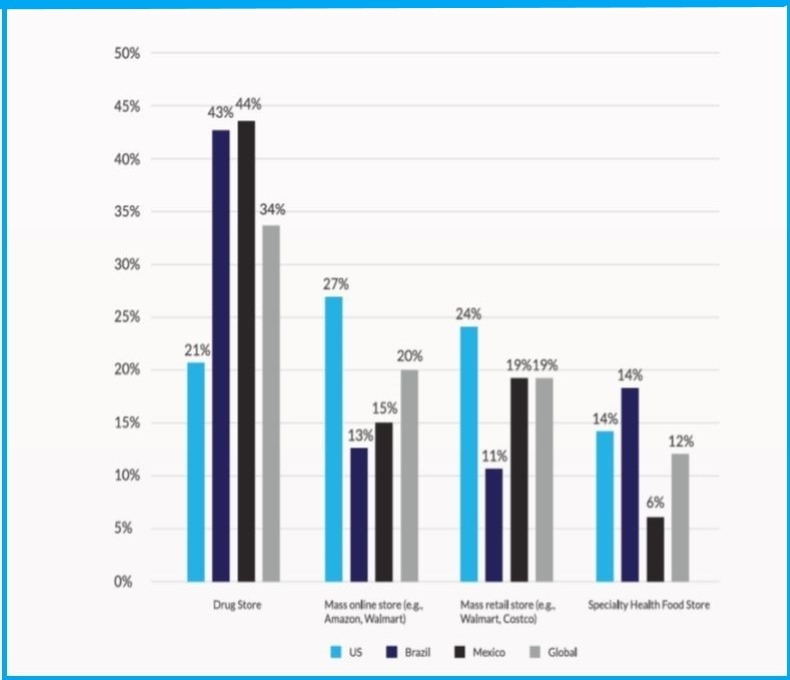

The different consumer practices in those markets should signal health care product marketers to an approach different from what they use in the US (see graph below).

“You can see those are very different. If you're if you're a consumer health care company, and you want to expand your product in those regions, you need to think about engaging with the HCPs or engaging with the doctor, the doctors and the nutritionists and the pharmacists and dieticians,” Dallabrida said.

“Then look down to the level of the local drugstores because that's where the decisions are being made. I think it's very interesting to think about the regional variations.”

US consumers’ higher interest in self-care could be linked to the drug industry’s work to expand the variety of health care products, from nonprescription drugs to nutritional supplements and from medical devices to wellness apps, available directly to consumers. (Also see "Innovation, Education Are CHPA Priorities To Help Consumers ‘Own’ Their Health Through Self-Care" - HBW Insight, 7 Nov, 2021.)

As well, the Food and Drug Administration encourages drug firms and other stakeholders to submit proposals for making available nonprescription additional active pharmaceutical ingredients currently Rx-only primarily to expand consumer’s self-care options. (Also see "Before Asking FDA For Novel OTC Switch, Be Sure DFL Alone 'Can't Get There'" - HBW Insight, 23 May, 2019.)

And during the COVID-19 pandemic, the FDA has provided developers with templates with data and information for emergency use authorization submissions for OTC home-use molecular or antigen diagnostic tests. (Also see "US FDA Grants Three OTC Covid-19 Test EUAs Following Template Updates To Spur Development" - HBW Insight, 23 Nov, 2021.)

Health Care Professional Recommendations Don’t Sell

Consumer health product marketers might not know what Sprim’s survey showed about consumers’ regard for one of the most common advertising tactics, surveys of health care professionals’ recommendations.

“A lot of the traditional reasons that I think the market thinks about sell much lower,” Dallabrida said.

“For example, about that old commercial saying, ‘four out of five dentists surveyed.’ No one cares about that anymore. That is, people are smarter than that,” she added.

Consumers typically need more information than a survey of dentists to impress them about a product’s claims.

“When we set out to do this study, we were curious, it was one of our big questions, what changes behavior? What changes buying decisions? What are people looking for on the label?” Dallabrida said.

While OTC drug and dietary supplement firms have been hesitant about offering more than the simplest information and data to support claims, they could connect more with consumers by offering more.

“Historically, I think there's been thinking that, maybe all of the science is too complex and consumers are looking for some other things, and to keep it very simple,” Dallabrida said.

“What we found, at least in my opinion, is different than that. We found that consumers have become very savvy about their purchases, and they are looking for evidence – evidence in the form of a clinical trial, or some studies that demonstrate that a particular consumer health-related product is effective as well as a safe.”

Smarter Consumer A Global Trend

Better comprehension and understanding of the science behind OTC drug and nutritional supplement claims wasn’t limited to one or some of the markets in the survey by the firm with offices in New York and in Orlando, FL, which showed clinical trials or other scientific research showing product efficacy was the top reason for picking an immune support supplement. (Also see "Science-Backed Efficacy Sways Consumers Most About Immune Supplements – Survey" - HBW Insight, 14 Dec, 2021.)

“For me, as a scientist, it was very refreshing. That's the kind of data that I look for to make a purchasing decision. But it was really refreshing to see that our global population came to that same conclusion,” Dallabrida said.

Some trends or preferences will vary by region, as regard for self-care varied between the US and the two Latin American markets Sprim surveyed.

“There were a lot of things in our survey where maybe that was the response was stronger in the US, or Mexico or Brazil, and so on. We will have regional variations, but we also have global trends,” Dallabrida said.

“One of the biggest global trends we saw is that consumers in Mexico, Brazil, and the United States, uniformly set aside the clinical trial, and that evidence, as number one, in terms of what would change their decisions – they're the most important to change a decision for them in regard to the buying behavior.”

Different Destinations In Different Markets

different consumer practices for buying dietary supplements in Brazil, Mexico and The us should signal health care product marketers to alter advertising approaches to the market.

Source: SPRIM Global

different consumer practices for buying dietary supplements in Brazil, Mexico and The us should signal health care product marketers to alter advertising approaches to the market.

Source: SPRIM Global