OTC COVID-19 Tests Diagnosed As Leaders In US Consumer Health Market Sales Growth – IRI

Well-Known Brands Led 2021 Consumer Health Launches, Including Test Kits

Executive Summary

Pandemic was taking away cough/cold OTC drug sales but giving consumer health industry a sales driver for dietary supplements, particularly products providing immune health benefits, while also giving diagnostic technology firms nearly half the top 10 launches in US consumer health in 2021.

The COVID-19 pandemic giveth to the US consumer health product industry and it taketh away.

Providers of OTC cough/cold drugs lamented slumps in sales during 2020 and 2021 as face mask-wearing became common and leaving home grew rare to prevent spreading the novel coronavirus but also prevented the spread of common cold and cough bug germs.

Abbott Laboratories' product led the four covid-19 test kits, above, at the top of IRI's list of highest-sellingt us consumer health market 2021 launches, which also included oral care, heartburn and pain relief brands, below. Source: IRI

While the pandemic was taking away cough/cold OTC drug sales, though, it was giving the industry a sales driver for dietary supplements (see image below).

The pandemic also gave medical diagnostic technology firms nearly half of the top 10 launches in the US consumer health market in 2021, according to market research firm IRI data on sales in stores and online.

“This was the year of the COVID test kit,” said Kristin Hornberger, Chicago-based IRI’s executive for health care, said on 17 March at the Consumer Healthcare Products Association Self-Care Leadership Summit in Ventura, FL.

“COVID test kits really topping the list, taking four of the top 10 spots this year,” she added.

Source: IRI

Although OTC test kits for COVID-19 are new to US consumers, a familiar brand led sales in the category, Abbott Laboratories Ltd. The trend continued for other top launches in consumer health, including US brands from cColgate-Palmolive Co., Procter & Gamble, Sanofi and Bayer AG (see images above).

Those launches’ results somewhat counter the strongest factor IRI sees in consumer health sales – pricing is behind 90% of consumers’ decisions in the space.

“But for these brands, a lot of innovation as well, that's driving about 14% of the growth for these brands for the consumer healthcare category,” Hornberger said.

Developers of OTC diagnostic technologies expect demand for their products will continue after public health agencies declare that COVID-19 has been eradicated as consumers continue preventive behaviors in addition to stocking at-home tests to use when concerned about potential viral infections. (Also see "OTC COVID-19 Tests Have Abbott Seeing Continuing Demand For At-Home Diagnostics" - HBW Insight, 23 Apr, 2021.)

The same is true for mask manufacturers. (Also see "Potential Consumer Demand For Disposable Masks Poses Industry Promise And Marketplace Peril" - HBW Insight, 29 Dec, 2021.)

To The Store With Shopping List

Demand for OTC COVID-test kits not only drove sales for the products, but also led to a jump spending in pharmacies and drug stores during 2021, IRI data showed.

All-outlets US market sales during 2021 grew on increasing realted to the covid-19 pandemic, with certain categories as key drivers, according to IRI data.

Source: IRI

All-outlets US market sales during 2021 grew on increasing realted to the covid-19 pandemic, with certain categories as key drivers, according to IRI data.

Source: IRI

“About COVID test kits, this was a tremendous opportunity for drug [stores] and really, really seemed an incredible turnaround,” Hornberger said.

Consumers made 49m more trips in 2021 to drug stores than during 2020, representing $2bn growth in sales for the stores, she added.

Consumers’ increased spending in stores accounted for 80% of the $880m in COVID-19 test kits sold from all outlets in 2021, according to IRI data.

Returning Customers Drive Sales

Known brands also took advantage of growing consumer demand for nutritional products during the pandemic.

Hornberger noted IRI data showed 77% of supplement and other nutritional product sales growth came from consumers who already were buying in the category putting more products in their shopping bags or online baskets.

Additionally, eight of the top 15 nutritional brands drove 20% growth in the category. “Big brands like Premier and we've seen this brand before many times,” Hornberger said.

All-outlet sales of Post Holdings Inc.’s Premier protein and meal-replacement bars grew $175m in 2021. Other nutrition brands IRI research showed big sales gains for were vitamin lines Olly from Unilever North America up $142m, and goli from Goli Nutrition Inc. up $127m; Phamavite LLC’s Nature Made line up $118m; Celsius Holdings Inc.’s Celsius beverages up $96m; Quincy Bioscience LLC’s Prevagen supplements up $94m; and Nestle Health Science’s Nature’s Bounty line up $92m.

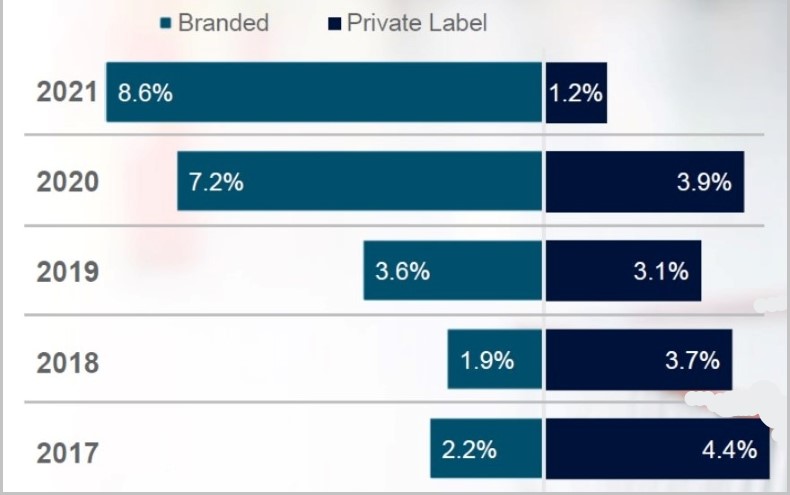

As well, across consumer health brand product sales are outpacing private label this year for the third straight year, according to IRI data (see image below). “Tremendous growth, tremendous growth by branded products,” Hornberger said.

Cold Season In Season

IRI, as OTC drug firms have reported in their 2021 fourth-quarter results, has found that the pandemic didn’t take away cough/cold OTC sales indefinitely.

“After an unprecedented kind of softness that we saw in 2020,” Hornberger said, sales for upper respiratory OTCs began to recover in 2021 “actually pretty close to 2019 sales.”

For the start of 2022, “there's some dropping off, but overall, a really good season compared to what we had seen in 2020 for upper respiratory.” The US upper respiratory OTC market slumped by $462m in 2020 and regained around $327m of that decrease in 2021.

The gap between US consumer spending on branded and private lable or store brand conmsumer health products has widened in the past two years, according to IRI data.

Source: IRI

The gap between US consumer spending on branded and private lable or store brand conmsumer health products has widened in the past two years, according to IRI data.

Source: IRI