J&J Without Consumer Health? Tylenol, Band-Aid Marketer Plans To Divest Business In Two Years

Executive Summary

“As we watch the health care landscape continue to evolve, we think that it's only incumbent upon us to think about what kind of an impact that should have on our portfolio,” says CEO Alex Gorsky. The dependable revenue driver with iconic consumer health brands will be separated from J&J’s Rx drug and medical device division as a standalone, publicly traded company.

Johnson & Johnson's company name has been synonymous with consumer health care with its brands from Tylenol to Band-Aid and from Listerine to Neosporin holding high market shares for decades.

The consumer health business also has been synonymous to the firm as a “growth annuity” for reliable revenue even when sales slump in the more volatile Rx drug and medical-device markets.

The dependable revenue driver along with its consumer health brands will be separated from Johnson & Johnson’s Rx drug and medical device division as a standalone, publicly traded company within two years in a plan the New Brunswick, NJ-based firm announced on 12 November.

J&J’s planned divestment puts it on the same track as GlaxoSmithKline plc, Pfizer Inc. and other pharmas have taken with their consumer health businesses, and that Sanofi has said it will follow, too (see related story).

CEO Alex Gorsky said during a same-day briefing with analysts that among other factors, consistent growth in consumer spending on self-care influenced J&J’s decision.

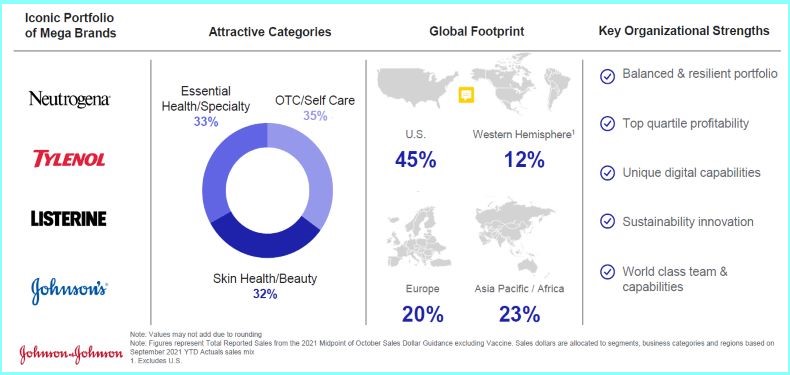

J&J laid out reasons from brands to market footprint to supports its decision to divest its consumer health business.

Source: J&J

J&J laid out reasons from brands to market footprint to supports its decision to divest its consumer health business.

Source: J&J

“As we watch the health care landscape continue to evolve, we think that it's only incumbent upon us to think about what kind of an impact that should have on our portfolio, how we allocate resources and … execute our strategies and operationalize those things each and every day with customers around the world,” said Gorksy, who will step down as CEO and continue as executive chairman in January. (Also see "J&J's CEO Gorsky Steps Aside With Duato Named His Successor" - HBW Insight, 24 Aug, 2021.)

“We've seen a significant evolution in these markets, particularly on the consumer side, whether it's the innovation being sought by consumers, whether it's the evolving nature of the channels, distribution, the shift to e-commerce and as we observe that and I must say, I think it was accelerated quite significantly with COVID-19, where we're seeing greater interest in personal care and taking care of families.”

Chief financial officer Joseph Wolk said the consumer product business’s results also drove J&J’s thinking.

“From a financial perspective, we are doing this from a position of strength,” Wolk said.

“The consumer health business specifically, if you look maybe four or five years ago, we had trouble on a quarterly basis hitting market growth. Now, we do that routinely and often exceeded and the operating margins, which were significantly below the peer set, are now at peer set, so even still a little bit of room to run.”

‘Separate And Distinct’ From Talc Business

What wasn’t an influencing factor, Wolk added, is J&J’s ongoing litigation in a string of lawsuits related to an alleged link between its talc products and ovarian cancer and other illnesses.

“In terms of any future talc liability, I think it's important to state upfront that today's announcement is separate and distinct from the talc liability and bankruptcy proceedings that were announced a few weeks ago,” he said

“We view a healthy consumer business as a growth annuity for J&J with less volatility than other markets.” – former J&J global consumer chief Sandra Peterson in 2015

J&J has separated its talc product operations into a standalone business, LTL Management LLC, to incur claims in the cosmetic talc litigation; it will fund the affiliate with a $2bn trust and a royalty stream with net value of more than $350m currently. In October, it announced that LTL filed for chapter 11 bankruptcy protection, a filing “intended to resolve all claims related to cosmetic talc in a manner that is equitable to all parties, including any current and future claimants. (Also see "J&J Has 18.2% OTC Drug Sales Increase In Hand, But Not Decision On Talc Business Bankruptcy Plan" - HBW Insight, 19 Oct, 2021.)

“We've taken that step in hopes of resolving that for all stakeholders with some certainty. We will let the bankruptcy court determine the appropriate adjudication of those liabilities,” Wolk said.

Design Due End Of 2022

J&J said it targets completing the planned separation in 18 to 24 months subject to satisfaction of conditions including required consultations with employee representative bodies; final approval of the board; “receipt of a favorable opinion and Internal Revenue Service ruling with respect to the tax-free nature of the transaction”; and other regulatory approvals.

Upon the planned separation, the “new” J&J pharmaceutical and medical device business, which is expected to generate around $77bn revenues for 2021, would be “the world’s largest and most diverse health care company” and would “continue its commitment to lead in global healthcare R&D and innovation, with a portfolio that blends its strong capabilities focused on advancing the standard of care through innovation and technology,” according to its announcement.

The planned organizational design for the consumer health company is expected to be completed by the end of 2022; its board and executive leadership will be announced during the planned separation process, which the company estimates will create costs of $500m to $1bn.

J&J’s consumer health company, which it expects to deliver around $15bn revenues for 2021, will market products in more than 100 countries and include four brands with $1bn annual sales and around 20 with more than $150m. The lineup also includes more than 10 market-leaders, such as Tylenol, Zyrtec, Listerine and Johnson Baby.

While a separate move from its talc business decision, divesting its consumer business makes it a slimmer target for potential claims.

Morningstar analyst Damien Conover said the divestment announcement “is surprising, as we don’t see any major catalyst for the move.”

“However, if the consumer division no longer holds the deep pockets of the combined company, the risk of future consumer product litigation – such as the large talc settlement – may decrease,” Conover said in a same-day research note.

‘Fundamentally Different Businesses’

During the briefing, Gorsky said the separate parts “have evolved as fundamentally different businesses.”

He said the differences include “the rate and pace of innovation, the level of science and technology involved” … “the investment required for clinical development plans” … “the regulatory pathways” and “the distribution channels where you're shipped through intermediaries versus a more business-to-consumer interface that we're seeing on consumer, as well as the actual sales and marketing.”

The pharma and medtech “businesses share many more common themes versus our consumer business, and we think that it makes strategic sense for these two businesses to continue to work together,” the CEO said.

SVB Leerink analyst Danielle Antalffy agrees the planned move as good for both parts of J&J’s operations.

Although J&J has considered consumer health product sales a reliable annuity, the business has slowed the firm’s overall results, Antlaffly said in a research note. The consumer business’s annual growth of around 3% to 4% is strong compared to other OTC drug firms, but J&J’s Rx drug/medtech business sales grow around 5% annually; as well, the consumer business’s operating margins are “in the teens range” while the pharma/device business delivers “peak margins in the high-20s and low-30s.”

Additionally, Antlaffly agrees with J&J management’s view that the separate parts of its business don’t complement each other.

“While there are synergies across the Pharma and Medical Device businesses, there was less so between Consumer and either of the other businesses, and this spin should enable new JNJ and the Consumer business to each be more nimble and dynamic in both organic and inorganic investments,” she wrote.

Gorsky Leaving With Mixed Consumer Health History

Worldwide consumer health and personal care product sales were up 4.1% to $3.7bn during the third quarter driven by an 18.2% increase in OTC drug sales. Excluding OTC drugs, the consumer business results for the quarter would have been down as sales for all the other sectors slipped.

Global consumer health head Thibaut Mongon said in October that for the July-September period, “the star is our OTC segment, growing double digit with continued strong demand for trusted brands in analgesics but also digestive health, continued demand in smoking cessation as well.”

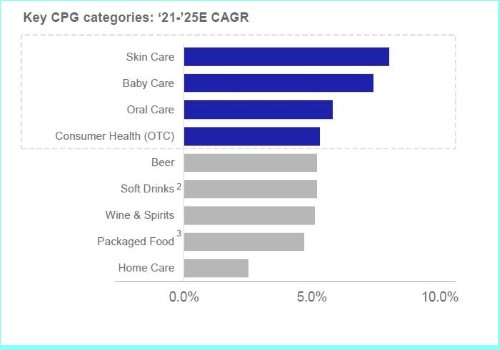

according to J&J, its consumer health business markets products in the top four consumer packaged good categories.

Source: J&J

according to J&J, its consumer health business markets products in the top four consumer packaged good categories.

Source: J&J

J&J’s earnings briefing in October was the final one with Gorsky at the helm. Stepping down in January after almost 10 years, Gorsky will be succeeded by Joaquin Duato, currently vice chairman of the executive committee.

Since Gorsky took J&J’s reins in 2012, consumer health sales have remained steady at around $14bn annually. He expanded the business favoring bolt-on acquisitions in fast-growing categories rather transformational deals made by rivals in the OTC drug and nutritional and personal care product space.

He beefed up J&J’s skin health/beauty franchise with the 2016 acquisitions of cosmetics firm NeoStrata Co. Inc. and hair-care player Vogue International Inc., and in 2018 took the firm into the natural vitamins, minerals and supplements space by acquiring Zarbee’s Inc.

Also in 2018, Gorsky oversaw an overhaul of the Johnson’s baby care brand, prompted in part by competition in the category from natural upstarts. The products were reformulated with more naturally derived ingredients and fewer ingredients overall.

More recently, under Gorsky the consumer health business has focused on cutting around 10% of its SKUs mainly in the baby and beauty categories outside the US to improve profitability.

But J&J’s consumer business has incurred increasing scrutiny concerning its sunscreen and talc products while it also litigates multiple complaints about its opioid drugs.

Gorsky’s challenges at the consumer health business began with the fallout of a US Food and Drug Administration consent decree in 2011 concerning good manufacturing practices by its McNeil unit. In addition to talc-related lawsuits, J&J currently is dealing with regulatory and class action problems related to the carcinogen benzene found in aerosol sunscreens it markets under the Neutragena and Aveeno brands.